reverse sales tax calculator ny

This is the amount that the government will collect in taxes on that purchase. Amount without sales tax GST rate GST amount.

New Development Closing Cost Calculator For Nyc Interactive Hauseit

Our calculator will automatically calculate the result and represents it in 3 different forms.

. Our free online New York sales tax calculator calculates exact sales tax by state county city or ZIP code. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Here is how the total is calculated before sales tax.

Amount without sales tax QST rate QST amount. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. When trying to determine how much sales tax to add to a transaction and whether or not a certain item should be taxed it is important to review your local tax rate and laws regarding what is taxable.

Amount without sales tax GST rate GST amount. Convert the Tax Rate to a Percentage. Amount without sales tax QST rate QST amount.

Calculate Reverse Sales Tax. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. For tax years before 2018 you have until October 15th of the year after making a conversion to reverse it and avoid the related tax liability.

Before-tax price sale tax rate and final or after-tax price. Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services. If the purchase comes to 100 the sales tax in New York City would be 850 100 x 00850.

You can also use our Sales Tax Calculator for Reverse Sales Tax calculation to skip the aforementioned manual method. You can use this calculator to calculate the sales tax that is included in receipts. And several of these states raise nearly 60 percent of their tax revenue from the sales tax.

New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Divide the Tax Paid by the Pre-Tax Price. Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100.

How to Calculate Sales Tax Backwards From Total. The harmonized sales tax or hst. Divide the Post-Tax Price by the Decimal.

Input the 85 Gross Price of Rug as Amount after Tax. When trying to determine how much sales tax to add to a transaction and whether or not a certain item should be taxed it is important to review your local tax rate and laws regarding what is. Sales Tax Rate Sales Tax Percent 100.

Convert the Total Percentage to Decimal Form. Input or select 800 of combined Sales Tax Rate on the Tax Rate. If the purchase comes to 100 the sales tax in New York City would be 850 100 x 00850.

Used Vehicles for Sale in Bayside NY. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. All you need is.

A sales tax decalculator will tell you the pre-tax price of a good or service when the total price and tax rate are known. Price before Tax Total Price with Tax - Sales Tax. Add 100 Percent to the Tax Rate.

The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. New York on the other hand only raises about 20 percent of its revenues from the. The next step is to multiply the outcome by the tax rate it will give you the total sales-tax dollars.

Reverse Sales Tax Calculator to calculate price before tax and the tax amount based on the final price and sales tax percentage. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Here is how the total is calculated before sales tax.

This is the amount that the government will collect in taxes on that purchase. You can calculate the Sales Tax amount you paid employing any reverse Sales Tax Calculator sometimes called the Sales Tax deduction calculator or using a simple formula. Reverse Sales Tax Calculations.

Formula s to Calculate Reverse Sales Tax. You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax. State and local sales reverse tax calculator de-calculator.

Subtract the Tax Paid From the Total. The Mansion Tax in NYC is a progressive buyer closing cost which ranges from 1 to 39 of the purchase price on sales of 1 million or more. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts.

The Sales Tax Formula used to calculate the final price inclusive of tax before tax price in case of Reverse Sales Tax is provided below. PRETAX PRICE POSTTAX PRICE 1 TAX RATE. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Sales TaxFinal Price Inclusive of Tax Before Tax Price 1 Tax Rate 100. Tax reverse calculation formula. The formula looks like this.

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Reverse Sales Tax Calculator Calculator Academy

Calculate Sales Tax On Car Sale Online 54 Off Www Ingeniovirtual Com

How To Calculate Sales Tax Backwards From Total

Calculate Sales Tax On Car Sale Online 54 Off Www Ingeniovirtual Com

Tip Sales Tax Calculator Salecalc Com

Kentucky Sales Tax Calculator Reverse Sales Dremployee

New York Sales Tax Calculator Reverse Sales Dremployee

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

How To Calculate Sales Tax Backwards From Total

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator 100 Free Calculators Io

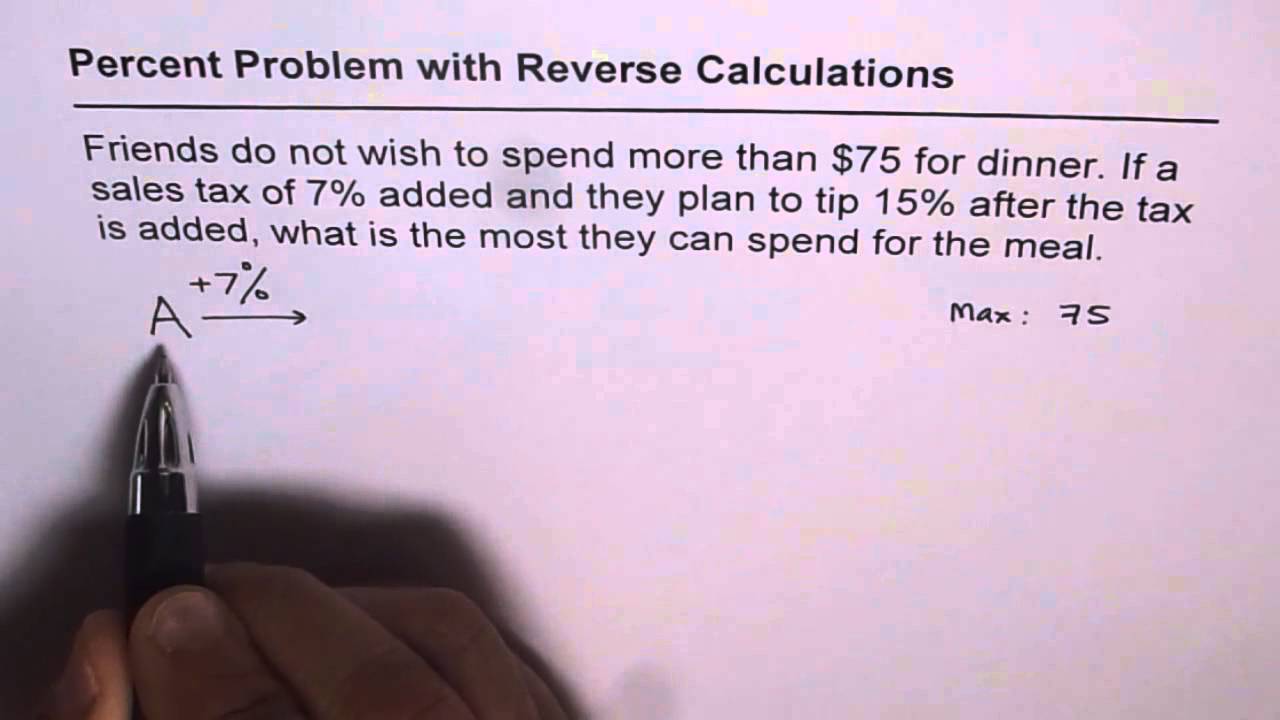

How To Calculate Amount With Percent Tax And Tip With Reverse Calculations Youtube

Reverse Sales Tax Calculator De Calculator Accounting Portal

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price